Divesting CPS from Fossil Fuels

- Sophia H.

- Nov 7, 2023

- 4 min read

By Sophia H. '24

Is CPS invested in the fossil fuel industry? The short answer is yes. The long answer requires you to know what the CPS endowment is and the strategy behind its management. In this article, I will give you an overview of how the endowment operates, the investment strategy used, and the merits and drawbacks of attempting to divest CPS from the fossil fuel industry.

What’s the Endowment?

The endowment is a sum of money that is perpetually invested and used to pay for aspects of CPS that aren’t otherwise covered by tuition or the operating budget. While the endowment is invested in perpetuity, the interest that it generates is not, meaning that a portion of it can be withdrawn each year to fund financial aid, supplement teacher salaries, and improve campus facilities (among other uses). As markets change, the endowment provides long-term support to the school’s budget, ensuring that it can continue to serve students for generations to come.

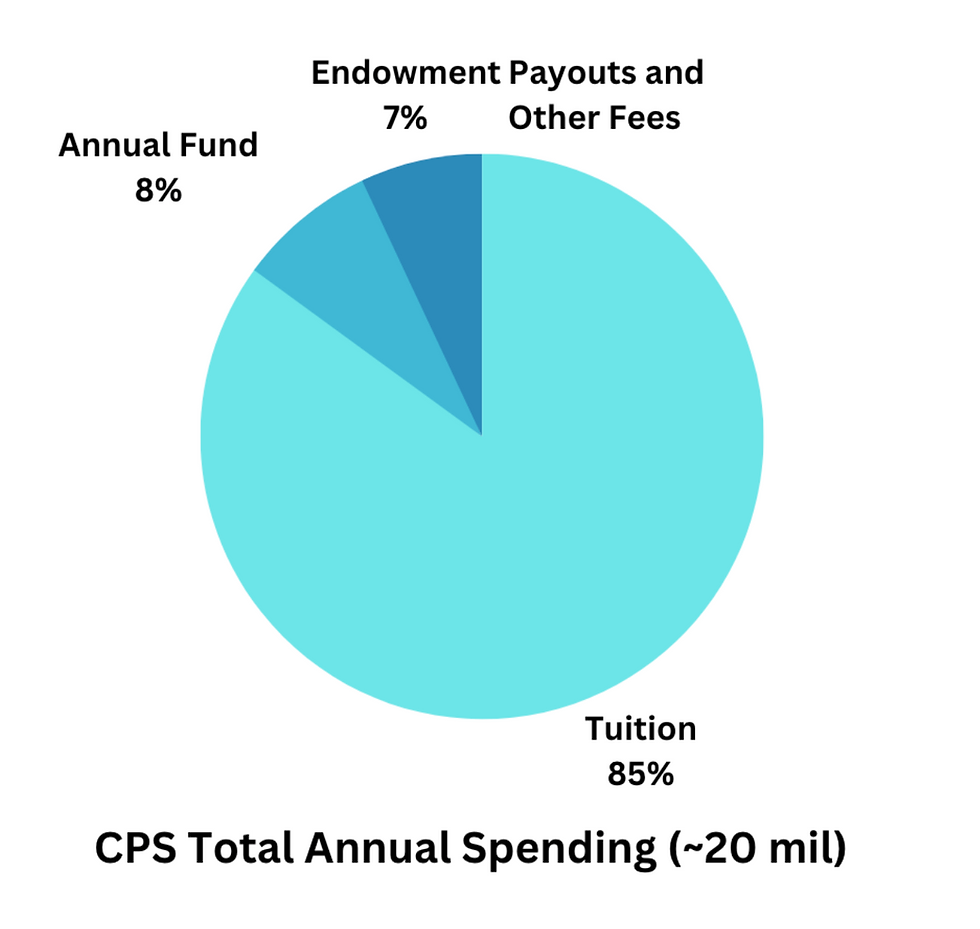

To put a number to it, the CPS endowment is currently valued at $25-26 million dollars, with about 8% expected annual growth. Of this 8%, half of it (or 4% of the total endowment) is paid out each year to supplement the school’s budget. Currently, payouts from the endowment make up less than 7% of the $20 million it takes to run CPS annually (depicted above). The rest is made up by tuition (85%) and the Annual Fund (8%). This is to say that while the endowment is important for long-term security, it doesn’t account for much of total spending.

The Investment Strategy

Rather than hire an in-house consultant, CPS outsources management of the endowment to Vanguard, an investment management company that works with institutions to grow their investments through Vanguard portfolios. The Investment Committee, part of the Board of Trustees, loosely oversees this management and determines the broad allocation of the money, designating 65% in public equity use, 30% in fixed income, and 5% in real estate.

The head of the Investment Committee, Tim Recker, informed me that while Vanguard is transparent with the Board of Trustees, much of the information is kept confidential from the broader CPS community. The most that he could tell me was the general 65-30-5 asset distribution, and that CPS’s portfolio with Vanguard can be easily guessed by looking at stock market indexes such as the S&P 500. Essentially, the investment strategy is very passive, attempting to get broad exposure to the market rather than to take risks for potentially larger payouts (and losses). The lowest-risk and lowest-cost option is to invest in an index like the S&P 500, which lumps the highest-performing companies together so that investors don’t have to spend time and resources picking individual stocks. Unfortunately, these indexes often include companies that derive their profits from the extraction and burning of fossil fuels, directly contributing to climate change.

While CPS’s portfolio with Vanguard is fairly static, the Board of Trustees can ask them to move investments around in order to best align with the mission of the school. For example, the Board ensures that there is no investment in the tobacco industry, which has a history of enticing young people into using products that are famously bad for your health. This begs the question, why hasn’t CPS divested from the fossil fuel industry, especially considering the long-term effects of greenhouse gasses and the threat they pose to our future?

Divestment

Divestment from the fossil fuel industry is not a new concept. New York City, Harvard University, and the country of Sweden are just three examples of the many entities that have divested from fossil fuels. Recently, a coalition of California private high schools have begun the process of divestment, including the Nueva School, Phillips Exeter Academy, Lick Wilmerding High School, and most recently, the College Preparatory School. Led by the Green Team and the newly formed Divestment Team, College Prep students are in the early stages of researching CPS’s involvement in the fossil fuel industry and organizing meetings with the administration to learn more.

But how effective is divestment? There isn’t definitive evidence that it causes mass social change, at least not on its own. One of the most cited examples is the 1980s disinvestment campaign in South Africa, which may have had a hand in the end of Apartheid, but was just one of many mounting global pressures against the regime. Similarly, the tobacco divestment campaign of the 1990s may have had an effect on decreased smoking, but litigation obscures many of these effects. While these campaigns weren’t the only contributors to social change, they played a part in stigmatizing certain assets so that the public would turn against them.

According to the Harvard Review, fossil fuel divestment has the potential to be the most successful divestment campaign in history, if only because of scale. If enough large institutions divest, we will eventually reach a turning point where fossil fuel stocks are so unattractive to investors that the entire industry crashes. While this may seem idealistic, many universities, cities, and investment management companies like BlackRock have already committed to fossil fuel divestment. Even Vanguard, the management company that CPS outsources to, offers divested portfolios. While divesting from the fossil fuel industry presents challenges and uncertainties, it aligns with the global imperative to combat climate change. As the movement gains momentum, it is essential for institutions like CPS to consider their responsibility in preserving the Earth for future generations and to take steps that align with this goal.

Want to learn more?

What I’ve covered in this article only scratches the surface of fossil fuel divestment. Check out the High School Divestment Coalition’s website to see how other private high schools have approached the topic of divestment. Reach out to the Green Team or Divestment Team to see how you can get involved. To learn about run-off, a proposed alternative to divestment, check out this Harvard Review article.

Comments